Blogs

- No-deposit incentive FAQ

- Bask Financial Usage Savings account

- Rate background for Forbright Bank’s family savings

- How do you Learn about The Taxpayer Liberties?

- What’s the difference between a high-yield savings account and you may a timeless savings account?

- Which need to have an internet higher-yield savings account?

In the most common things, the brand new tax withheld from the spend might possibly be around the taxation your contour in your get back for those who realize both of these regulations. You will want to go through which exact same procedure each time your daily life condition transform, whether it’s for personal or economic reasons. For many who don’t have the proper number of withholding on the very first Models W-4 and W-4P your complete, you ought to refigure your withholding by using the suggestions and worksheets within the which guide, or perhaps the information in the above list. Dining table step 1-dos reveals many of the income tax credits you might be in a position to use to cut back their withholding. To have an entire set of credit you might be in a position to claim, see the 2024 Guidelines to have Form 1040. If the a general change in individual things reduces the number of withholding you’re entitled to allege, you have to provide your employer another Function W-4 within ten months after the change happens.

No-deposit incentive FAQ

All of our book explores preferred june tenancy and you will put points while offering suggestions to reduce disagreements and you will minimise the necessity for formal quality at the conclusion of the newest tenancy. No-fee Overdraft Exposure as much as $50 for SoFi participants having $1,000 or more altogether month-to-month head deposits. The term ‘new money’ refers to money moved to the bank account of outside-the-financial supply. Knowing the built-in balance away from deposits is essential. As opposed to almost every other monetary instruments which might be susceptible to field activity, repaired places render a secure choice having notably down risk.

Bask Financial Usage Savings account

When you completed filling in the brand new 2024 tax get back, the end result try a keen overpayment away from $750. You credited $600 of your overpayment to your 2025 estimated tax and had the rest $150 given because the a reimbursement. If your projected income tax does not transform once more, the necessary projected taxation payment to your 4th fee several months often be $step one,025. The required estimated taxation fee to the 3rd fee several months is actually $dos,175. Their revenues is all earnings you will get in the function of money, products, possessions, and you will functions one isn’t excused out of income tax. To choose whether or not a couple of-thirds of your own gross income for 2024 are from agriculture or angling, have fun with as your gross income the total of one’s income (maybe not losings) quantity.

Rate background for Forbright Bank’s family savings

- The new payer of your own retirement or annuity have to deliver a observe telling you regarding the straight to prefer to not have income tax withheld.

- Direct from household income tax filers will get a full percentage if they gained $112,500 or smaller.

- At the same time, while the brokered Dvds try ties, purchasing one means not one of one’s paperwork that’s needed is when to purchase a lender Computer game.

- It does not take very long to discover the online game you need, and also the amount offered will get stun you.

In the a brick-and-mortar bank, you can often find discounts cost closer to the brand new national mediocre, that is currently 0.38%. Insolvency of your issuerIn the big event the newest issuer techniques insolvency or gets insolvent, the new Video game may be placed within the regulating pop over to the web-site conservatorship, to your FDIC generally designated as the conservator. Just like any deposits out of an excellent depository institution listed in conservatorship, the new Dvds of the issuer by which a good conservator has been appointed can be paid back ahead of maturity otherwise relocated to various other depository establishment. Should your Dvds try transferred to some other business, the brand new business can offer you the option of preserving the newest Cd from the a lesser interest rate or choosing payment. You need to use Agenda LEP (Function 1040), Request for Change in Language Preference, to say an inclination to get observes, letters, or other authored communications in the Irs inside an option language. You do not quickly discovered created correspondence in the questioned vocabulary.

How do you Learn about The Taxpayer Liberties?

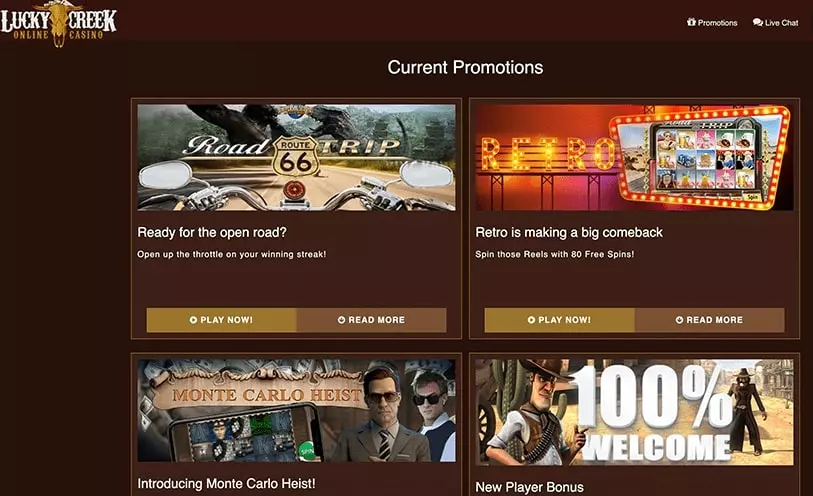

Basically, they show up while the in initial deposit fits or fee bonuses. Free of charge to you – you’re going to get the credit for just doing another gambling enterprise account. Simply click any of the no deposit extra backlinks over to help you protected the very best render. If the zero password is needed, clicking from link in this post and you can finishing your own subscription tend to cause the advantage becoming added to your the brand new membership. You must discover a new McLuck Local casino account so you can allege the fresh invited promotion.

What’s the difference between a high-yield savings account and you may a timeless savings account?

Flower Co. try a manager having a schedule tax year you to recorded the punctual 2024 tax get back to your April 15, 2025. Rose Co. decided to go with to take the new accredited business payroll tax borrowing from the bank for growing look issues on the Form 6765. The next quarter from 2025 ‘s the basic quarter one to initiate immediately after Flower Co. submitted the cash income tax get back making the payroll income tax borrowing from the bank election. Therefore, the fresh payroll income tax borrowing from the bank is applicable against Flower Co.’s share of social security tax (up to $250,000) and you can Medicare income tax for the wages paid so you can group in the 3rd quarter out of 2025. Consistent with the entries on the internet 16 or Schedule B (Function 941), the newest payroll taxation borrowing from the bank will likely be taken into account to make deposits out of employment taxation.

Which need to have an internet higher-yield savings account?

The fresh stimuli percentage will be when it comes to a taxation credit that could let as much as 400,000 low-earnings doing work houses in the usa. Beginning in April 2025 houses that will be determined qualified to receive Summer EBT will get an initial Notice away from Eligiblity to own Summer EBT Professionals. This type of notices ought to include the new child(ren) which can be eligible for Summer EBT, details about accessing pros, information about opting from June EBT pros, and how to file a destination.